Irs Business Expense Categories 2024 – Audits will be focused on aircrafts used by large corporations, large partnerships and high-income taxpayers with a look at allocation between business and personal use. . According to the IRS, 20% of eligible taxpayers don’t know about the Earned Income Tax Credit, yet it could add thousands of dollars in tax savings back into their pockets. .

Irs Business Expense Categories 2024

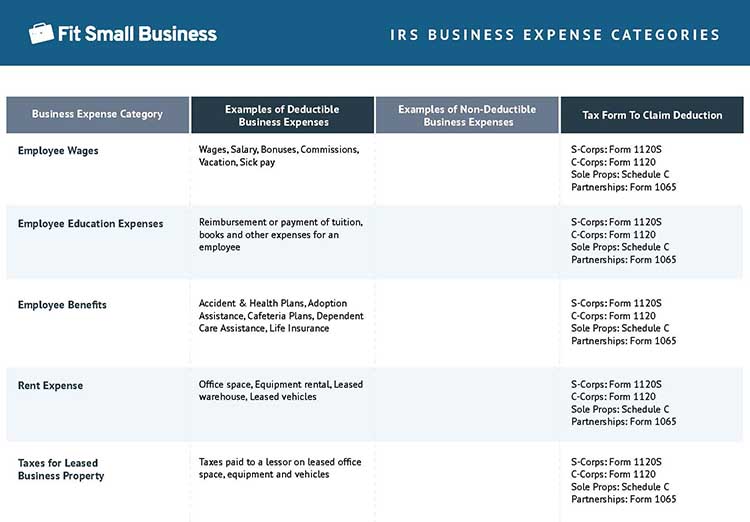

Source : fitsmallbusiness.comKey Categories of Business Expenses for Taxes in 2024

Source : www.shoeboxed.comBusiness Expense Categories Cheat Sheet: Top 35 Tax Deductible

Source : www.fylehq.com25 Small Business Tax Deductions To Know in 2024

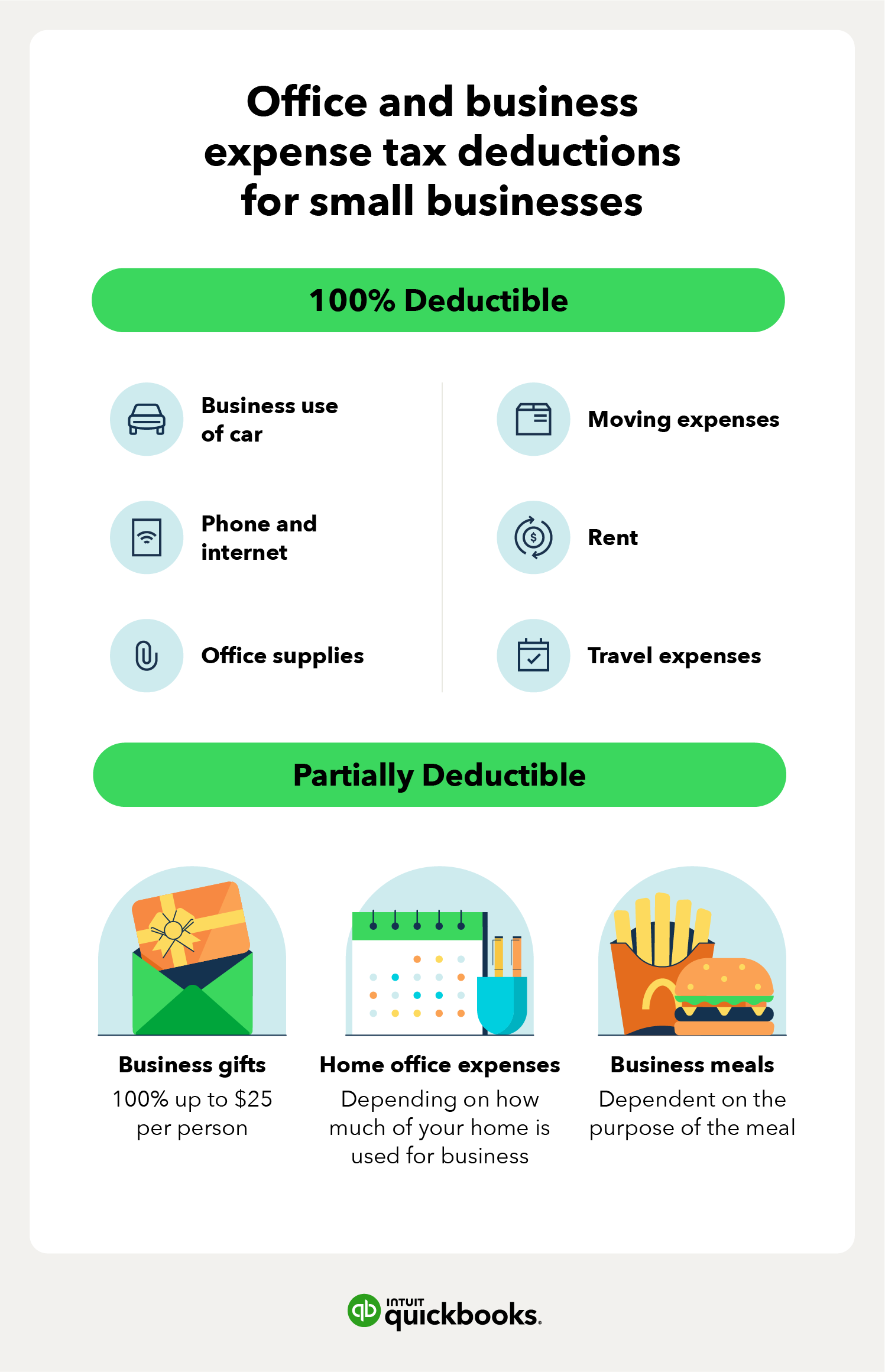

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSmall Business Expense Categories to Write Off | Constellation

Source : blog.constellation.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 IRS Business Mileage Rate of 67 Cents Informed by Motus Data

Source : www.motus.comBusiness Expense Categories Cheat Sheet: Top 35 Tax Deductible

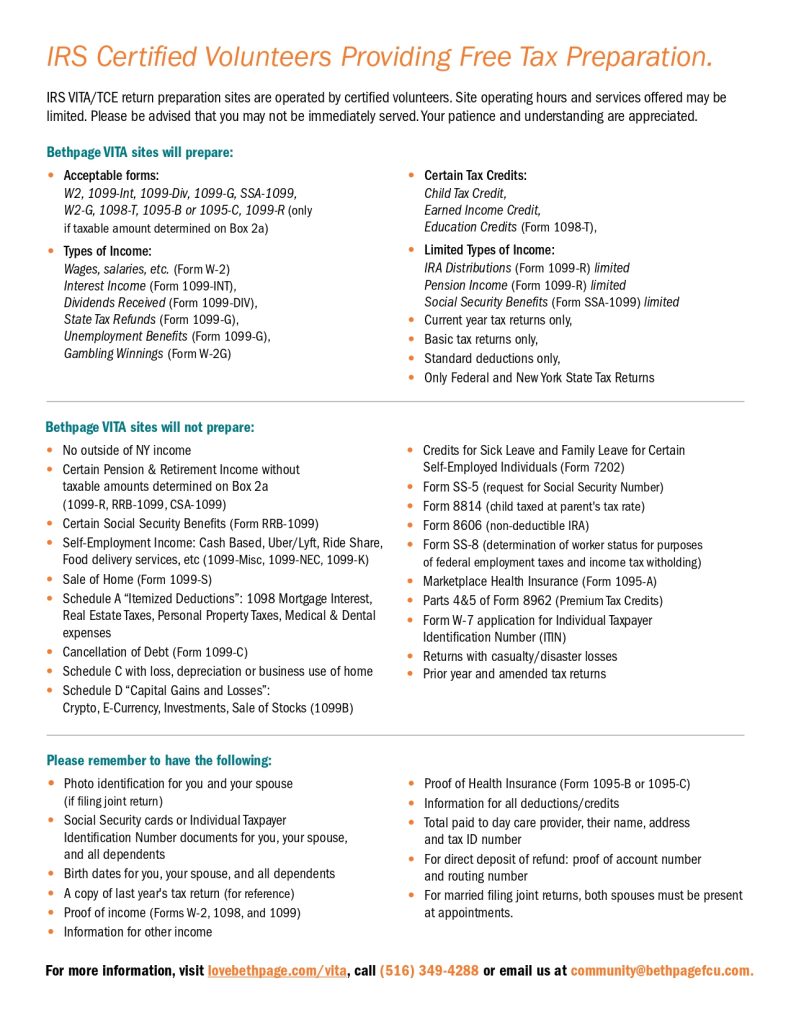

Source : www.fylehq.comFree Tax Clinic Bethpage VITA at Touro Law University – Nassau

Source : www.nslawservices.orgIrs Business Expense Categories 2024 IRS Business Expense Categories List [+Free Worksheet]: If you run a small business, particularly one that has employees and offers benefits such as a workplace retirement plan, then recent tax changes could affect you this tax filing season. For You: Does . IRS leadership said Wednesday, Feb. 21, 2024, that the agency will start up dozens Now, there will be more scrutiny on executives’ personal use of business aircraft who write it off as a tax .

]]>