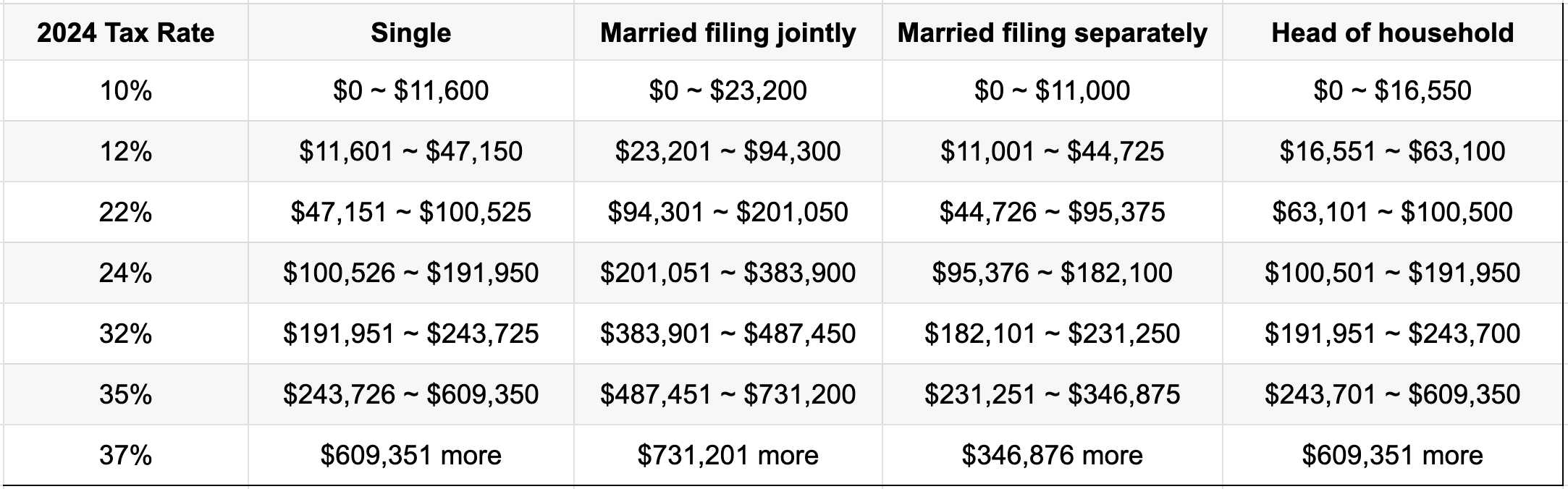

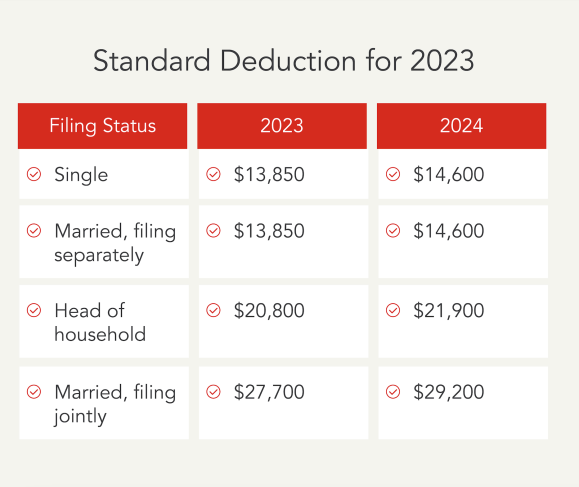

Income Tax Itemized Deductions 2024 – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . Taking advantage of these often overlooked tax deductions can help you lower your tax bill. .

Income Tax Itemized Deductions 2024

Source : www.blog.priortax.comKick Start Your Tax Planning For 2024

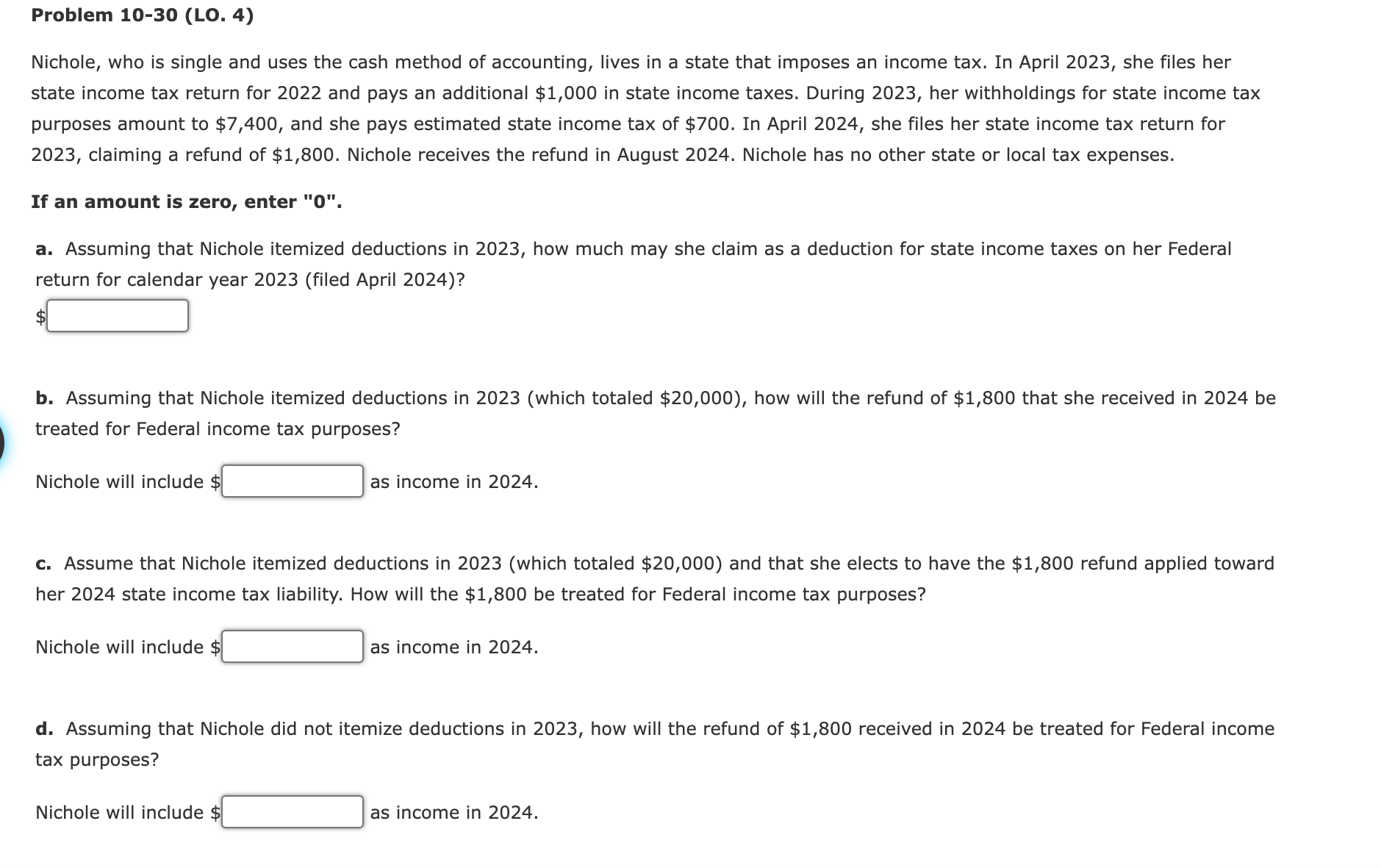

Source : www.benefitandfinancial.comSolved Nichole, who is single and uses the cash method of | Chegg.com

Source : www.chegg.comStandard vs. Itemized Deduction Calculator: Which Should You Take

Source : blog.turbotax.intuit.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

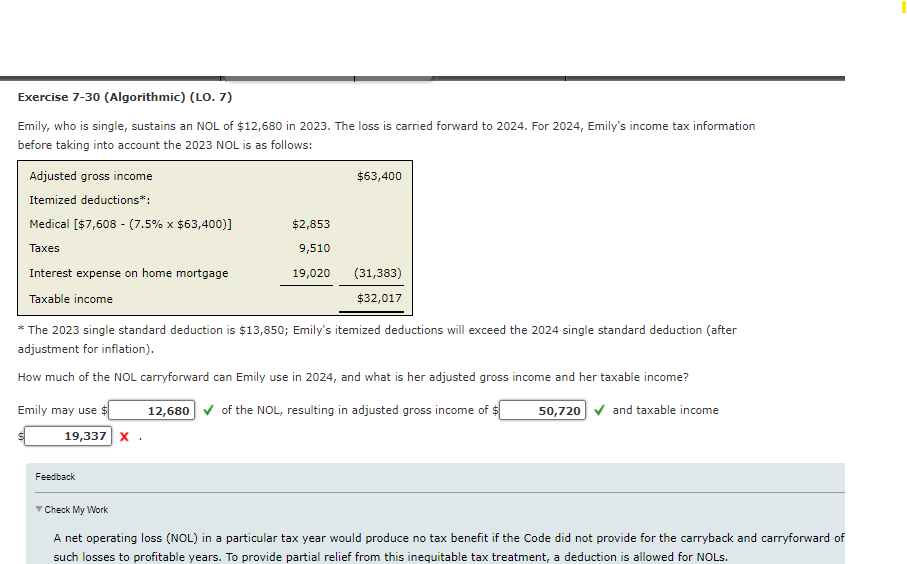

Source : turbotax.intuit.comSolved Exercise 7 30 (Algorithmic) (LO. 7) Emily, who is | Chegg.com

Source : www.chegg.com2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc.

Source : thefinancebuff.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govYear end tax strategy ideas as 2024 approaches Sol Schwartz

Source : www.ssacpa.comIRS: Here are the new income tax brackets for 2024

Source : www.cnbc.comIncome Tax Itemized Deductions 2024 Tax for Business | Blog Post Categories | PriorTax.com: Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. . Learn more about it. Itemized deductions are expenses you have incurred throughout the year that can be used to reduce your taxable income. It can be taken in lieu of the standard deduction—a set .

]]>